Residential Market Update

With this ever changing real estate market, it is important to be well educated on current market trends to make the best decision.

Note:

Hello,

Happy New Year! I hope everyone had a fabulous holiday season as we enter into 2026. In 2025, the GTA housing market became more affordable as both home prices and mortgage rates trended lower. This improvement in affordability has positioned the market for a recovery. As households gain confidence that the economy and labour market are on solid footing, sales activity is expected to pick up.

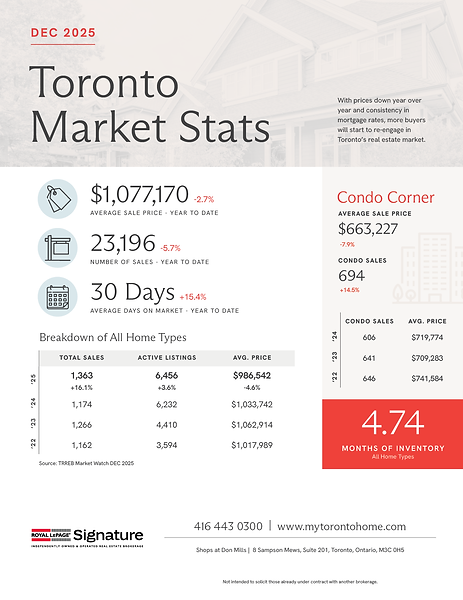

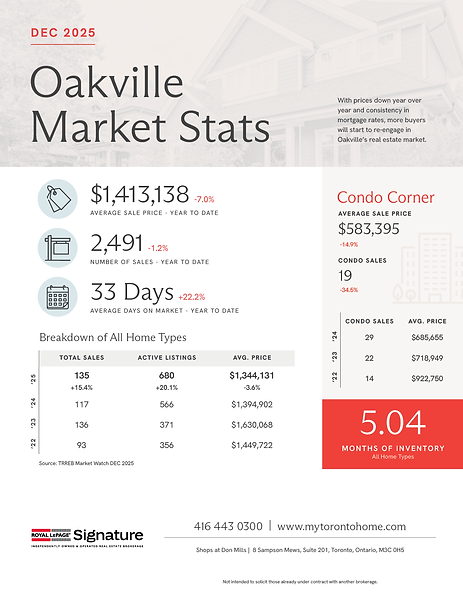

For the calendar year 2025 saw 62,433 home sales of all types, down by 11.2% compared to 2024. The annual average selling price was $1,067,968, down by 4.7% compared to $1,120,241 in 2024.

In the month of December there were 3,697 home sales reported, down by 8.9% compared to December 2024. The average selling price was $1,006,735, down by 5.1% compared to last year. On a seasonally adjusted basis, December home sales were down slightly month-over-month compared to November 2025, while new listings were up.

Looking ahead, the outlook for 2026 appears increasingly positive, with many leading economists forecasting a stronger housing market, driven in part by recent statements and guidance from the Bank of Canada. For borrowers, this signals a more stable interest rate environment, one where rates are expected to hold near current levels rather than continue the volatility seen in recent years. While rates may not return to historic lows, the prevailing expectation is for consistency rather than sharp movement.

Further, the Toronto Regional Real Estate Boards Chief Information Officer Jason Mercer re-affirmed that trade relationships and major domestic economic development projects will be essential to improving home sales in the months ahead. GTA households need confidence in their job security before committing to long-term monthly mortgage payments, even in a more affordable market.

As a result, 2026 is shaping up to be a year with a renewed sense of certainty that will influence buyer behavior. Many prospective purchasers who had remained on the sidelines amid uncertainty are expected to re-enter the market, encouraged by clearer expectations around mortgage costs and improved confidence in planning for homeownership.

Best,

Lawrence